Risk management #1: Position sizing | cleo.finance Trading Guide12 min read

Many novice traders believe that success lies in finding trading systems that enter and exit the market at the right time. On many occasions, they neglect an aspect that has proven to be much more important and easier to achieve than timing: risk management.

In this article, we will demonstrate how crucial position sizing is to your trading success, as well as how to set the position sizes effectively, how to calculate position sizes based on risk, how to determine the correct distance, and finally reveal a quicker way to do it all. In the end, you will know exactly what to do to never expose yourself to taking a crippling loss again.

Stop losses on their own are covered here.

Table of Contents

Risk management and position sizing

Position sizing is determining the correct size of the position based on the amount of money you risk on the particular trade. Before you can do that, you need to figure out what is the maximum acceptable risk of the trade. That risk is usually expressed as a % of your balance, that you are willing to lose. To make sure you don’t lose more than this amount traders set a Stop Loss order. Stop losses should not be appropriated randomly. In fact, it is the real maximum exposure of your position.

Let’s say your portfolio is $10,000 and trade has a 5% stop loss. The position doesn’t go your way and you lose $500. In the absence of a Stop Loss, you may lose significantly more, even your entire portfolio.

A tight stop loss with not much wiggle room can be closed by normal market movements and you may miss a trade that could have potentially been profitable. A wide stop loss placed too far could require entering a position so small, that the potential profit might be too insignificant. A trailing stop loss may be a good option too, you just need to understand how to use it well.

Why is position sizing so important?

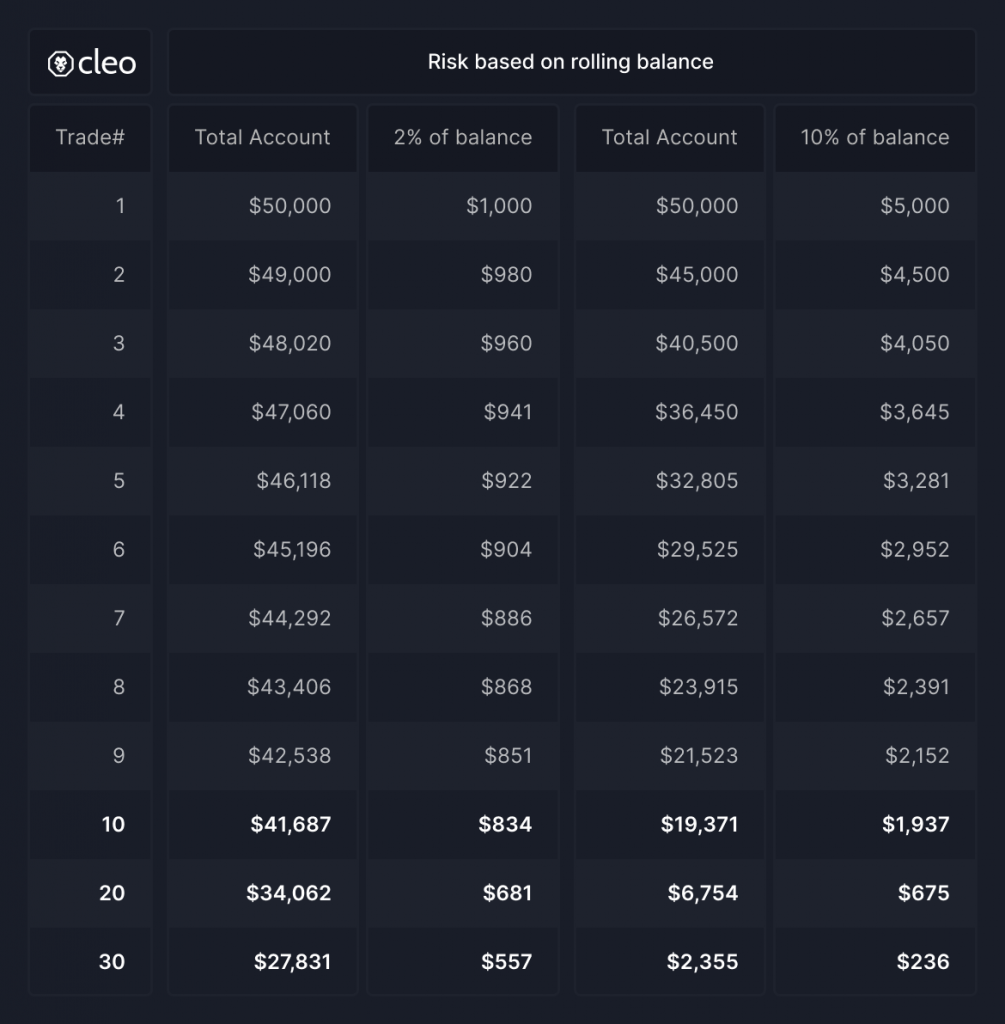

Position sizing is simply too important of a factor for traders to determine on the fly. In the table below we see the difference between risking 2% and 10% of a balance on every trade. After only a string of 8 losing trades in a row, we have less than half of the portfolio left, making it exponentially harder to achieve profitability with every new loss we encounter.

There are many different approaches to setting position size that works for you and many great traders have different risk exposure based on the perceived strength of the signal their strategy generated, so having unique exposure for every trade is not out of the question.

The rule of thumb is to risk between 1-3 % of your portfolio balance on each position. This way any single individual loss won’t wipe your account and break your spirit. And more importantly, even a string of losses will leave you with enough ammunition to recoup the losses.

Backtesting is the only way to know if your stop loss is well set

First learn how to think about position sizing. Then select the approach that suits you well and get to backtesting. It does not matter if you trade forex, crypto, stocks or are creating a trading bot – It’s the only way to know if you’re leaving money on the table.

Make sure that the backtesting statistics you’re working with make it easy for you to improve your trading strategy.

How to think about position sizing

These methods cater to all traders and balance sizes.

Fixed position sizing

The first approach is using a fixed position size. This may be useful for traders with large account balances, that don’t wish to use percentages of their balance as even a small percentage would be a substantial sum.

If you are always risking $100 for example, your losses do not compound, but neither do your wins. It is recommended to use when trying to determine if your trading strategy has an edge (in backtesting), as compounding wins/losses would skew the underlying efficacy of the strategy.

It is advisable while using fixed position sizing to come back in regular intervals to review the strategy’s performance and adjust the entry sizes.

Cleo.finance allows you to use both the base and quote currency for a fixed position sizing, as well as setting the initial margin, which enhances your flexibility.

Flexible position sizing

The other method for position sizing is to use a percentage of the current balance. This will expose you to the benefit of compounding if your trading is going well and will slow down bleeding if it isn’t.

Flexible position sizing – wins compound

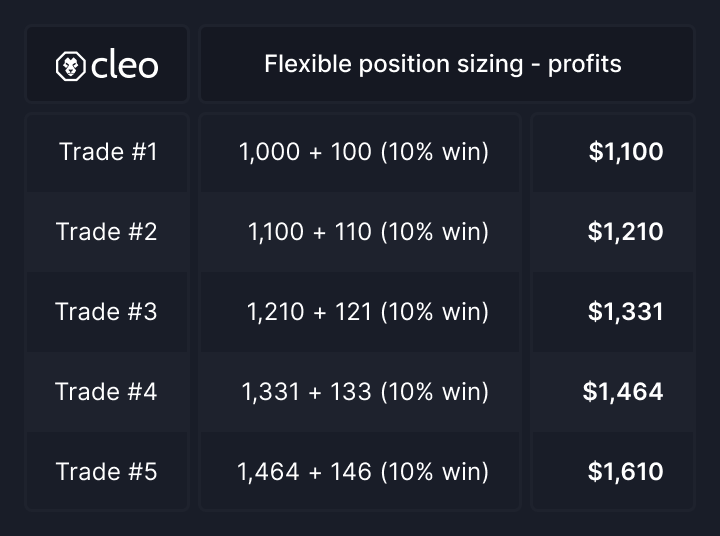

Using a percentage of your trading account in each position entry has the advantage of compounding. Assuming you do not remove any funds, the profit made on each trade increases your overall balance. Giving you larger gains. The anthesis is also true. Using a percentage means your losses are less. For a quick example let’s say your balance is $1000 dollars. You trade the full amount, 100% and you win 10% on each trade consecutively. Your balance would be as follows:

Your ending balance on the 5th trade is $1610 dollars. Not what some may expect of 10% on 1000 each win, which would yield you $1500. You bagged an additional $110 dollars thanks to compounding by increasing the position size.

Flexible position sizing – losses get smaller

On the losses side, let us see how the same example goes.

Your balance ended up at $592 dollars. If you expected to lose 10% on each trade, then you would expect your ending balance to be $500 dollars. Therefore, using the dynamic percentage methods for position sizing can be advantageous for capital preservation.

Calculating position sizes

Just like the market doesn’t care about your feelings, it doesn’t care about how much you are trying to win or are willing to lose. Majority of retail traders would look at the chart to see where the stop loss could be (usually behind some Support or Resistance line or based on some volatility indicator, such as ATR). Then take your account risk rule in mind – say you want to risk 2% of your balance on a single position. How big should the position size be if you want your stop loss to lose only 2% of your balance?

We’re going to explain it through an example. To do it you will need to know:

- Trading account size

- Trading account risk (what % of your account do you want to risk on this trade)

- Invalidation (Stop Loss point in form of a distance from the open price)

This will give you the position size:

Position size = Trading account size x Trading account risk / Invalidation

Calculating position size – example:

This is for the math-minded, if not interested skip this chunk.

We have a $10,000 trading account and would close the position if we see a 4% drop in price as an invalidation. We are willing to risk 1% of our trading account on this trade.

The position size formula gives us:

Position size= 10,000 x 0.01/0.04 = 2,500

Our position size is $2,500, with a stop loss of 4% of market price movement. With this, we are risking a maximum of 1% or $100 dollars if our stop loss is triggered.

Let’s say we want to have a looser Stop Loss of 8% instead of 4%. In that case, the formula would take this form:

Position size= 10,000 x 0.01/0.08 = 1,250

Doubling the distance to our stop loss (from 4% to 8%), has us reducing our position size by half to maintain the same possible loss.

How to set position size in cleo.finance

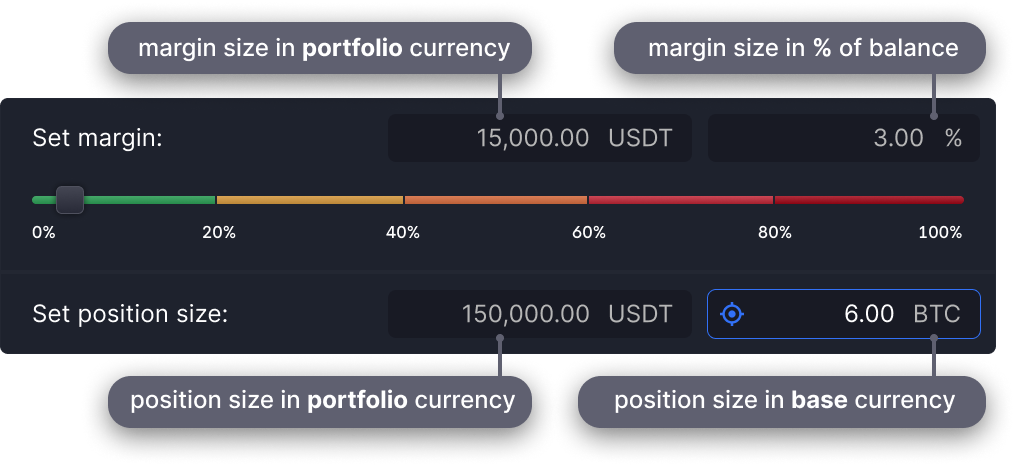

Position size is set using the Volume section in the Asset Management section of the Cleo Trading platform. This section allows for setting the position size in 4 different ways:

1. Setting the position size using the portfolio currency

Whatever amount you use here, will be the portfolio currency, which is USDT. The example above is using the crypto pair BTC/USDT. USDT here is the quote but also portfolio currency, so you are setting position size in USDT. If you enter 1,000 USDT, that is the amount it will use to open a position every time, no matter the asset or its current price.

2. Setting the position size using the base currency

In this state, you specify the amount of the base currency you wish to use for your position size. In the example above it is using the crypto pair BTC/USDT. So, it will use BTC for positioning. If you enter 1 BTC, it will always open a position of 1 BTC, no matter what the current BTC price is in USDT.

3. Setting the margin size in portfolio currency

When you first start trading you will have an initial balance. Irrespective of how your balance changes, assuming you have enough capital, your position size will be a percentage of your initial balance. For example, your initial balance was $1000, and you double your balance to $2000. If you use 10% of your trade sizing, it will use the initial balance of $1000 to create the position and not your balance of $2000. Thus, your position size will be $100.

4. Setting the margin size as a % of your balance

This is the only flexible position setting size you need. If you select the position size this way, it will always open a position of a size that is equal to the selected % of your current balance. For example, if you have a $1000 account and set the position size as 10% of the balance, then your position size will be $100.

How to set the position size correctly – example

First, we pick the leverage we want to use. Next, we add a new Stop Loss and input the distance or market price of the stop loss. Using a feature called “target” we can set which of the 4 Stop Loss values we want to anchor. This value will stay the same if we edit other settings, such as leverage or position size. By default, the platform anchors the first field you input, but you can change this anytime.

Learn how to best trade with your stop loss.

Based on our calculated example above, we would set Stop Loss by anchoring the market price distance in %. Now we need to watch the PnL values, as we move the Position size to fit our risk preference (in the gif below it is 5%).

We can very easily control exactly what our exposure is while understanding all variables involved. We can even add multiple Stop Loss orders, which can help us limit the exposure for example in the lower conviction plays.

Conclusion

Investigating your position sizing, including where you set a stop loss is imperative to understanding how long you can stay in the trading game. It is also deeply connected to your trading strategy.

You can set position sizes as dynamic by % or fixed. Learning to calculate position sizes in relation to your stop loss will create a more systematic approach to trading and protect your funds. What approach you choose depends on the asset you are trading and your risk tolerance. Backtesting is a great starting point in terms of finding the optimum.

With cleo.finance’s trading platform you get greater reassurance that you fully understand your exposure and have full control over the position sizing. There is no magic formula, but once you understand the principles it is easy to efficiently implement them.