Risk management #2: How to set a Stop Loss | Cleo Trading Guide15 min read

“Set a stop loss!” is maybe the most repeated advice that new traders get and then ignore. Just google “cryptocurrency trading liquidations” and you’ll see articles coming out practically every day citing liquidations of $100M and more (or check data here). It is definitive proof that traders in this market are not yet adopting proper risk management practices.

In the pursuit of long-term profitability, you need to become proactive in protecting your funds. Entering a position from the perspective of what you are risking, rather than what you stand to gain is the differentiator between the traders that “make it” and the rest.

In the second installation of our Cleo Trading Guide focused on Risk management we will repeat why stop losses are needed, what kinds exist, and how to think about them correctly in the context of your trading system.

Table of Contents

Why is stop loss so important?

Every time you enter a trade, you expose yourself to the risk of losing your capital. If you don’t use a stop loss order, you are exposing your entire portfolio to a loss every time you trade. It’s that simple.

Stop loss, therefore, defines the risk you are taking for that particular trading opportunity. Understanding this risk leads to you opening a position of the correct size (more on position sizing here). And by doing just these two things correctly you are practically certain to survive on the markets. Neato, huh?

Trading without a stop loss is the testimony of a lacking trading system or strategy. It makes you easy prey to your emotions and mistakes like adding more to losing positions or aggressive revenge trading. One of the masters of trading psychology Mark Douglas speaks about fundamental truths in trading and keeps repeating the following: “Anything can happen.” If you truly take this perspective seriously you will not dream of opening a position without a stop loss. Sentiment in the markets changes by the hour and 20% candles are more and more frequent. Don’t fall victim to a false sense of security and lose your account.

Even if you are not trading with leverage the opportunity cost of holding an underwater position while other assets are beaming with opportunity is painful.

The uncomfortable yet necessary part of trading is accepting, that having a losing position is fine. Closing it according to plan is great – gets you out of the trade and leaves you ready for the next one. If you are not willing to accept a loss and instead hold onto the trade, trading is simply not for you. Understanding how your losses add up and how much you have to make to get your account back is very sobering:

At the end of the day people start learning about stop losses in one of 2 ways:

- Even before they start trading and risking their hard earn money

- After they’ve lost their account. Then lost it again. And again. Then they quit or if they are lucky enough to still have some capital and start trading with stop loses

Which one are you?

What’s the ideal stop loss distance from the open price?

The distance of your stop loss will depend on your trading strategy and the market. If you are trading a small altcoin that has daily volatility of 20% a stop loss within a 2% distance from the open price will probably close your position quickly. Whereas a “stable” forex pair like EURUSD can be traded with the same stop loss for days.

There are only three things that you need to know about your trading to be able to determine if you are profitable or not. It is the win rate, risk/reward ratio, and trading fees. If you win every other trade you place (50%), but win twice as much as you lose, you will succeed.

There are two main ways to think about how stop loss comes into this equation:

- Tight stop loss – close to where the position is opened

This will most likely result in fewer winning positions = a lower win rate, so the risk/reward ratio must be favorable, and the trading fees must be reasonable (I’d say that is a common theme throughout all trading).

- Loose stop loss – far from where the position is opened

Loose stop loss will lead to a higher probability of a higher win rate, so the risk/reward ratio does not have to be aggressively higher.

It is not an easy task to find your perfect stop loss placement, but there are tools that you can lean on.

How to determine where to set a stop loss

Some strategies have a close rule based on an indicator or market conditions: “I will sell when RSI reaches 75.” Others are based on a distance from the open price: “Will sell if the market price drops 10%.”

Amongst the most popular options are:

- Price invalidation based on Support or Resistance levels

- Volatility indicators, such as Average True Range (ATR)

- Trend indicators

- Fixed PnL stop loss

- Trailing stop loss based on market price distance

We will have a look at each of them in little more detail.

1. Stop loss using Support and Resistance price levels

With this approach, you have identified a zone where a strong price action happened in the past, and you are expecting the price to sustain itself above or below that price level. Read more on S/R lines on Investopedia.

For example, on USDJPY we are seeing a test of a 20-year resistance at the moment. If our trading strategy generated a SHORT (sell) signal at this moment, we might want to use this 20-year strong resistance area and put our Stop Loss above it.

We have put our Stop Loss 2,5% above the current market price, which would mean that the price would have to break through the resistance by more than 200 pips. Since we are going for a 7,5% gain, we have a comfortable 3:1 risk/reward ratio. (This is only a hypothetical scenario)

2. Stop loss based on ATR or another volatility indicator

ATR is a popular Stop Loss-defining indicator amongst the forex trading crowd. It shows us what is the average volatility based on the data from the last 14 (default value) bars. The idea behind using it is simple: I better put my Stop Loss outside the zone of normal volatility to avoid getting stopped by normal/average/expected market moves.

The market mood is quite negative at this point, so let’s say we want to SHORT (sell) the S&P index. ATR value on the daily is 92.2, which means that on an average day from the last two weeks the 1-day move on this asset was 92.2 points on either side. Since we’d like to make sure our SL is not hit during normal market movements, we chose to take this value and multiply it by 1.5, and that’s where we place our protection.

What other indicators you could use? In general envelope indicators such as Bollinger Band®, Keltner, or Donchian Channels can provide value in assessing Stop Loss levels.

4. Stop Loss based on the trend

There are many ways traders try to identify a trend and its strength. We could talk about these methods in another article if there’ll be a demand for them, but the easiest way to analyze them using Technical Analysis would be through moving averages (MAs). Whether you are looking at the slope of the moving average, its relationship to the price (being above or below the MA), price, or another moving average with different settings crossing it (fast and slow MA cross combinations) – all of these options can help you determine the trend direction.

Let’s have a look at Solana’s chart. As the entire market plunged Solana was no exception. As you can see Exponential Moving Average (EMA) of period 50 worked as resistance several times. Its slope shows us that the downtrend is cooling off now, and even the retests of this line are more and more powerful. But if we wanted to use this EMA(50) as a Stop Loss for our entries after these retests, we would have done well for ourselves.

5. Fixed PnL stop loss

This is generally not a very efficient way to place a Stop Loss, because the market doesn’t care what % of your account you are willing to lose. If you’re for example always opening a position with the same size and using the same, say 2% stop loss, it will get placed on price levels with no regard to the previous market movements, volatility, or anything else but your balance. This can lead to you getting stopped out a lot, even though the underlying signal might be good.

Knowing your maximum acceptable loss per trade is very important. However, you should use that value in confluence with the above-mentioned methods to determine your position size. More on that in our first article in the Risk Management series.

6. Trailing stop loss

This dynamic way of setting stop losses follows price. If you set a 5% trailing stop loss and the price keeps going up, the stop loss moves up with the price. It can be useful in trending markets or when the asset enters price discovery and traders don’t have known price levels to work with.

This detailed explanation of how a trailing stop loss works will get you up to speed quickly.

Not many exchanges feature this option, and it is something we are adding in the upcoming few weeks to the cleo.finance trading platform.

Types of Stop Loss orders: market vs limit

Once you set out to actually set a stop loss your exchange or broker will typically greet you with 2 options: limit and market order stop losses. The differences are not big but in particular circumstances, they can have massive implications. It’s important to understand them and decide what works for you:

- Limit orders: set a specific price and can be executed only at that price.

This stop loss can be set off only if there’s a buyer at that price. Price can also reach this level, but if there are more people trying to sell at it, it might not trigger for you.

Limit orders tend to cost less than market orders as they are considered “market-making.”

- Market orders: set to trigger when a certain price is reached, although the actual execution price may vary.

The main difference is that when your asset reaches the price you’ve set as stop loss a market-based order will be placed, and you will get rid of 100% of your position, even if it means undergoing a slippage.

Slippage becomes a big issue mainly in 3 situations:

- The market is trending strongly

- The market is illiquid

- Your position is too big for the current depth of the order book

If you are trading some new altcoin or the price is ruthlessly trending down, there might not be buyers at the price point to which you set the stop loss. Large positions can “eat up the order book” on execution this way, especially in illiquid trending altcoins. These additional costs are usually tolerable for the majority of retail traders, with having the certainty that the order will be executed.

Limit orders do not have these issues. A limit order is executed only if your price is met. However, if there is no or not enough demand for your asset at that price, you won’t be able to close your position fully.

What you use is up to you and how likely is the price to spend time at your stop loss level.

Stop Limit orders

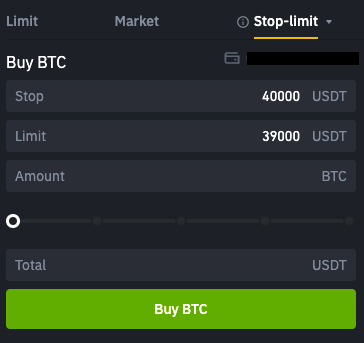

There can be even more niche categorization of limit orders: stop limit orders. These are conditional orders that use 2 prices: the stop price and the limit price. When the stop price has reached the limit, the order is placed on the exchange. For example, I want to buy Bitcoin but only after it attempts to break $40,000 and I believe it will dip a bit if there’s a rejection. So I will set the Stop Order at $40,000, with the Limit Order at $39,000 to take advantage of the possible rejection:

It can work for selling too. If I am afraid to lose profits I can set the stop and limit at a price that allows me to do so.

How to execute your stop loss

1. Manually

You will sometimes see traders doing this, watching the price and manually clicking when the level is reached. This is fine if you are an intraday trader that spends time watching all the trading pairs you have open positions on and don’t leave open positions overnight.

However, when things start moving violently, particularly in crypto you will often not have time to react, and your stop loss might turn into a loss much greater than planned.

2. Automatic stop loss

This is the more conventional way these safeties are implemented. To echo Douglas again, if you truly believe everything might happen in the markets at any time you will not have a reason not to set a stop loss.

Exchanges vary in what they offer. For example, Binance features a few different types of stop loss, but you can’t set it as trailing. Experienced traders from long-standing markets usually use a platform through which they can do it all on different exchanges and brokers.

In cleo.finance you can set several simultaneous take profit orders and stop loss orders, close positions based on indicators or price movements, and set position sizes with a lot of flexibility. If you are trading multiple assets and have several setups you use, using a professional trading platform can make a big difference in your efficiency, and therefore in your profitability.

Either way, I strongly believe that having an automatic stop loss is the way to go. Not because of what you are expecting to happen, but because of all the scenarios you cannot imagine.

How to set a Stop Loss: Conclusion

The question about using a stop loss is not about your preference but about your acceptance of the unpredictability of the markets. There are a few choices any new trader needs to make, like what kind of order types to use, what to base the stop loss on, and how to execute it. Whatever they determine as best, the use of stop loss will ensure their longevity in the markets.

If you’d like to implement any of the approaches noted in this article, head over to cleo.finance.