Backtesting – how to test your trading strategy on historical data5 min read

Testing your trading strategy on historical data (backtesting) is considered to be the first step in verifying its validity. That’s why in cleo.finance we focused on making the backtesting software as realistic as possible, with plenty of editable attributes, date ranges, timeframes, and a whole lot more! Crypto traders can test their strategies on 1-minute data available since 2017! Forex and stock traders have even more data to work with. It is a fast, realistic, and in-depth look into your trading strategies with detailed statistics.

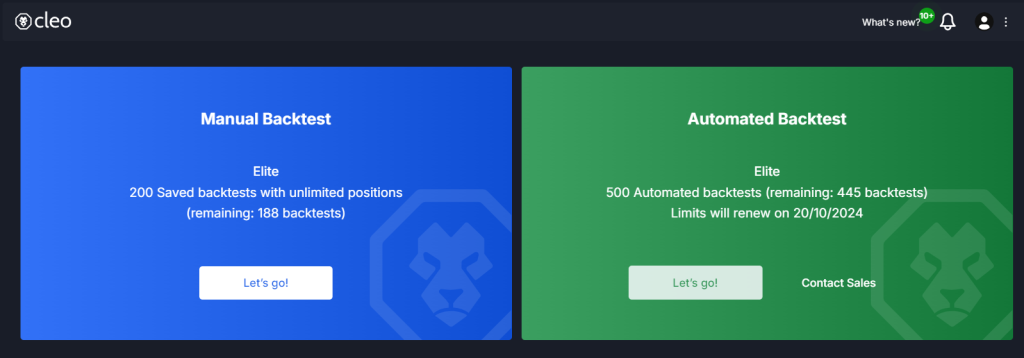

Here we are focusing on our Automated Backtester. If you’d like to know more about our Manual Backtester with Market Replay we are really excited to have you use it.

Just head to Automated Backtesting.

You can create your strategies in minutes using the Automated Loop feature, backtest them instantly and get your results with extensive statistics in seconds even for the complex ones. This backtesting software also accounts for the transaction costs and fees for more realistic backtesting results. Set your own slippage, commissions or funding fees.

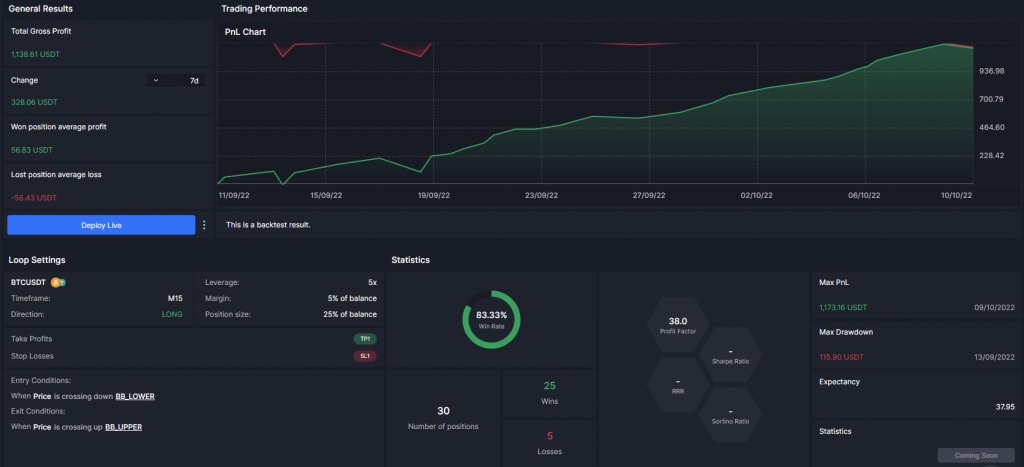

The backtesting results statistics will give you:

- Your total gross & net profit

- Average win and loss

- Your Loop (Strategy) settings – Entry&exit conditions, time frame, position, leverage, etc.

- Profit factor

- Sharpe ratio

- Profit/Loss ratio

- Sortino ratio

- Your win-rate along with the total won and loss number of positions

- Max PnL, Max Drawdown, trade expectancy and much more

See how you can improve your strategy incredibly fast with the results from our backtesting software.

Above, you can view your Position History for your backtest along with all the data you need. All positions can be replayed in candle-by-candle detail. You can study your backtest performance, review trading outliers and try to gauge how you’d feel holding each position.

How to use the backtesting software?

It is a straightforward process; all you need to do is go to Automated Loop and create your own custom automated trading strategy there.

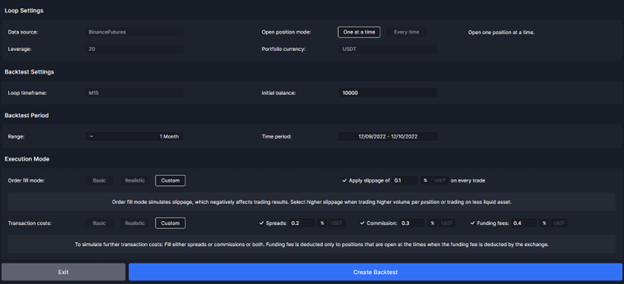

Enter your exit and exit conditions with the ever-expanding dataset, combine it with advanced risk controls, and view your trading setup on an integrated trading chart. Once you are content with your trading strategy, hit the “Create and Backtest” button.

The next window is the backtest settings. Here you can modify the initial balance of the strategy, set backtesting period, and customize the transaction costs. You can simulate trading slippage, funding fees, spreads, and commissions – all can be set in basic, realistic or custom mode. Click the “Create Backtest” button next and you will get your results in seconds.

If you are satisfied with your backtest results, you can deploy it with one click by hitting the “Deploy Live” button. If not, click three dots next to it and select Duplicate. You’ll be able to change anything about the strategy that you think caused it not to perform optimally – stop loss/take profit orders, any of the conditions, execution timeframe, or even the asset. Just watch out for overfitting! And if you need a primer on Position Sizing and Stop Loss management, we have blog posts ready for you!

How many Backtests I can run per month?

Our backtesting software offers much more than Automated Backtesting including Manual Backtesting with the Market Replay feature for forex, stocks and crypto. Check out the full pricing details.

The number of Automated Backtests you can run depends on the pricing plan you have:

Free Plan – Only for OKX users

- 50 Backtests per month.

- The historical lookback period for 1M – 1 Year

- The historical lookback period for 5M, 15M, 30M, 1H, 4H, 1D – Max

Trader Plan

- 50 Backtests per month.

- The historical lookback period for 1M – 1 Year

- The historical lookback period for 5M, 15M, 30M, 1H, 4H, 1D – Max

Trader Pro Plan

- 200 Backtests

- The historical lookback period for all time frames (1M, 5M, 15M, 30M, 1H, 4H, 1D) – Max

And in case you’d need more backtests, live-trading slots or you are interested in using cleo.finance platform in your company, send us an email.

You can save your valuable time and focus on your improving your winning trading strategies with cleo.finance’s easy-to-use, comprehensive, and efficient backtesting software. Sign up today and start creating your backtest right away!