Cryptocurrency backtesting and crypto trading bot creation – no coding5 min read

Creating a crypto trading bot and backtesting a trading strategy is on every serious crypto trader’s list. However, most approaches are quite inefficient, time-consuming or require you to focus on too many other things when you should be trading. In a 24/7 market you need tools that let you be active when sleeping.

So, instead spending time on programming, gathering data, doing things manually or backtesting in Excel we’re shedding light on a much simpler approach: using the best backtesting crypto software that lets you deploy your best trading strategies as crypto trading bots.

How can I backtest cryptocurrency trading strategies?

Many crypto traders think they can skip backtesting and get lucky, when in fact simply preparing can be a real edge in these markets. Backtesting can be done in 2 ways:

1. Automated Crypto Backtesting:

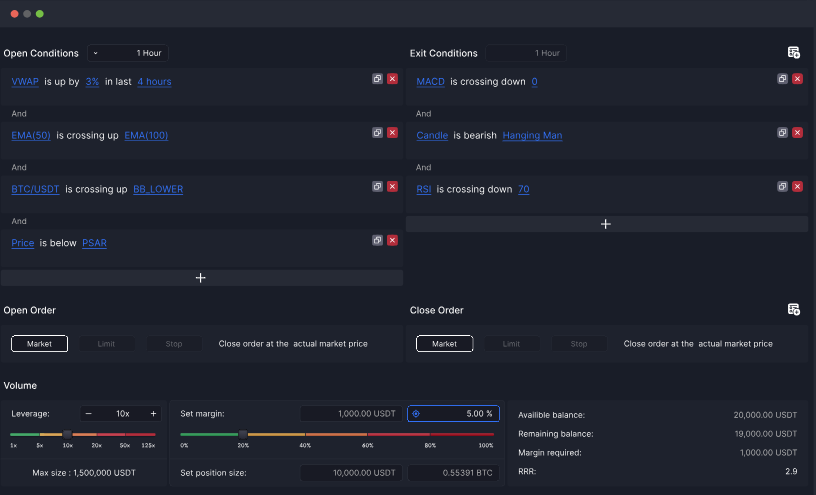

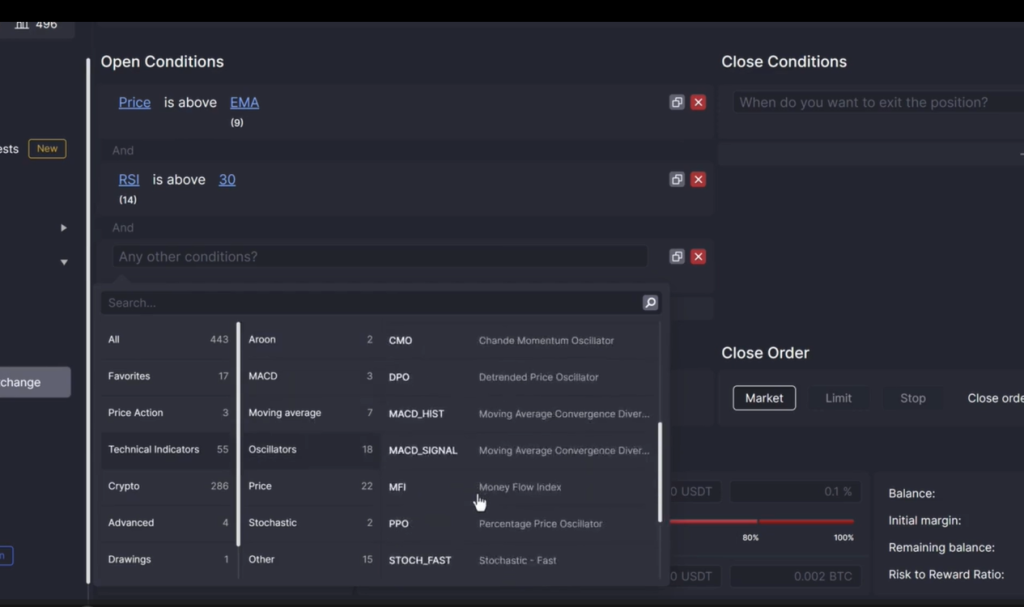

Type in entry and exit conditions, set Stop Loses and Take Profits if you’re using them and test the strategy on historical data. You can also adjust leverage, use multiple Take Profits and Stop Loses. Best of all the strategy input is super easy so you can go through many variations until you have a winner.

You can even use drawings to backtest trading patterns like the Cup and Handle Pattern, Bull Flag Pattern, or Bump and Run Reversal Bottom Pattern. We have an entire series where we explain popular Bulkowski patterns and demonstrate how to turn them into crypto bots.

Of course we feature all popular trading indicators, including some custom ones like Bullish and Bearish Divergencies.

If you’re just starting out and need crypto trading strategies to begin testing, the platform features free templates that can get you started. In fact, we show the results used in trading Bitcoin for the week on @cleo.finance every Friday.

2. Manual Crypto Backtesting – Market Replay

Replay the market and simulate your trading. This is a really great way to go in depth on your strategy, while getting confidence in your execution. It takes more time than Automated Backtesting but lets you be flexible and test any strategy.

Draw on the chart, trade like you normally would. cleo.finance has data on Bitcoin and alts going back to the time when that pair was featured on the exchange. Play the chart at varying speeds and investigate price action in detail down to the 1 min.

In order to automate your trading you need to be able to formulate your entry and exit rules after you’re done with backtesting.

When you complete a manual or automated backtest you immediately get backtesting statistics that tell you exactly what to fix in your trading strategy. Not just win rates, or Sortino Ratio but also best trading times/days, win streak expectancy, risk of ruin, drawdown, and many other details.

Run your best strategy as a crypto trading bot

You don’t have to go through the backtesting process to create your bot. You can just set up a strategy and then trade it on Binance or OKX.

We even feature templated trading strategies that can get you started on creating your own or you can trade them with a couple of clicks.

Plus we offer Affiliate Programs that allow you to earn for referring friends to cleo.finance.

What kind of strategies can I automate and run as crypto bots?

You can use all popular indicators, correlations with other assets (if SOL is up by 1% in the last hour, buy WIF), use support and resistance – whatever you like.

Here’s the full rundown on the process:

Trade crypto using multiple Stop Losses and Take Profits or Smart Conditions

If you are not on board with full trading automation you can also set one-off positions on cleo.finance. They can be conditional: “buy when RSI is above 50 AND price is crossing up EMA 25” or placed immediately.

Positions can be closed in the same way. Or you can manually enter whenever you see fit and place your Stop Loss and Take Profit, (multiple or single) through the platform as a % of price.

Conclusion: Cryptocurrency backtesting and crypto trading bot creation

Competition in crypto trading is ever increasing and while the markets do allow for volatility, can also be rapidly changing. Without backtesting your trading strategy you’re exposing yourself to 24/7 unpredictability.

On the other hand crypto trading bots allow you to be in the market when you can’t be in front of the screen. There’s no better feeling that running a strategy you have full confidence in without needing to do much. Getting to that point used to require coding and data gathering, but with cleo.finance you can skip all that and get started on trading profitability today.

If you are serious about your PnL you need tools that give you an edge, start now.