The four trading fears and how to overcome them9 min read

Trading in the financial markets, whether it be forex or cryptocurrency, can be a thrilling yet challenging experience. It requires a level of strategy, discipline, and risk tolerance to make informed decisions and reap profits. But, as traders, we are often faced with fears that can cloud our judgment and hinder our success in the market.

You got shaken out, but what trading fear got to you?

To help you overcome these fears, we will delve into the four main categories that traders face: fear of being wrong, fear of losing money, fear of leaving money on the table, and fear of missing out. These fears can be crippling, but with the right understanding and approach, they can be conquered. Join us on a journey to understand these fears and how to overcome them, so you can become a confident, successful trader in the forex and cryptocurrency markets.

Table of Contents

1. Fear of being wrong

The fear of being wrong is the most common obstacle for traders. It’s only natural to want to be right all the time, but in the fast-paced and ever-changing world of trading, being wrong is an inevitable part of the process. But this fear can hold us back from making the bold and calculated decisions necessary for success.

When we’re too afraid of being wrong, we may avoid taking calculated risks, miss out on potential profits, or even make impulsive decisions based on emotions instead of data. But here’s the thing: being wrong is a valuable opportunity to learn and grow as a trader. Every misstep is a chance to analyze what went wrong and improve our strategy for the next trade.

So instead of letting the fear of being wrong hold you back, embrace it. Embrace the possibility of being wrong and use it as fuel to become a better trader. Remember, even the most successful traders make mistakes and face losses all the time. The key is to learn from those mistakes and come back stronger.

2. Fear of losing money

No one wants to watch their hard-earned capital disappear, but in the world of trading, losses are a fact of life. However, letting this fear control our decisions can be just as detrimental to our success as the fear of being wrong.

If we’re too afraid to lose money, we may be hesitant to take calculated risks, miss out on potential profits, or even exit positions prematurely. But here’s the truth: losses are an integral part of the trading process and can be managed with a solid trading plan in place. By implementing risk management techniques, such as stop-loss orders, traders can minimize their losses and protect their capital.

So instead of letting the fear of losing money paralyze you, turn it into a strength. Use it as motivation to develop a comprehensive trading plan that incorporates effective risk management strategies. Accept that losses are a natural part of trading, and use them as an opportunity to improve your strategies and refine your approach. Don’t be afraid to lose money, be afraid of not taking advantage of opportunities to grow your wealth.

3. Fear of leaving money on the table

The fear of leaving money on the table is a tricky one, as it often arises when we’re in a winning trade. It’s tempting to hold on, hoping to squeeze out even more profits. But this can be a dangerous mindset that can lead to ignoring stop-losses and exposing ourselves to unnecessary risk. After all, you don’t have a crystal ball (and aren’t an FOMC member), so you should expect to buy the exact bottom and sell the exact top.

Instead, you need to have a clear exit strategy in place and stick to it, no matter how much you feel like the trade can continue to go in your favor. By having a predetermined exit plan, we can lock in profits, manage risk, and avoid emotional decision-making.

So, instead of succumbing to the fear of leaving money on the table, embrace discipline. Develop a solid exit strategy that balances the desire for profits with the need for risk management. Don’t be afraid to lock in your profits, even if it feels like there’s still money to be made. Trust in your strategy and stick to your plan, and you’ll be in a better position to capitalize on future opportunities.

4. Fear of missing out

The fear of missing out (FOMO) is a feeling that all traders have faced at some point. It’s especially prevalent in a volatile market, where prices are moving quickly, and it can be tempting to jump in without fully analyzing the situation. But succumbing to FOMO can lead to hasty decisions based on emotions, rather than logic, which can result in costly mistakes (emotions causing mistakes…do you see a pattern?).

It’s important to resist the temptation of FOMO and stick to your trading plan, even when the market is moving rapidly. By having a clear strategy in place and following it, we can avoid impulsive trades and make informed decisions that are grounded in logic and analysis. Take the time to thoroughly analyze each opportunity before making a decision. Trust in your strategy and stick to your plan, even when it feels like the market is passing you by.

How to overcome our fears

For a brighter reader, it is easy to notice that these fears are omnipresent. No matter what you do or don’t do during your trading day, you can’t avoid these fears. Overcoming them is not easy, but it is essential for achieving success in the market. Here are a few pointers that can help you overcome these four fears and become more disciplined and consistent traders:

Develop a solid trading plan:

Having a well-defined trading plan can help us to manage our risks and make informed, rational decisions. A good trading plan should include our goals, risk management rules, and entry and exit strategies. By following our plan, we can stay disciplined and avoid making emotional decisions based on fear.

Practice risk management

Risk management is an essential part of trading, and it can help us to overcome our fear of losing money. By setting clear stop-loss levels and position sizes, we can minimize our losses and protect our capital. This can give us the confidence to take on appropriate levels of risk and pursue potential trading opportunities.

Realize that your ego is the enemy

How many times have you held a losing position past your stop loss and literally prayed for the break-even? Did anything fundamentally change about your position? No, you just didn’t want to take the loss, am I right? See, even though we know that losses are part of the process it is still very hard for us to accept that any trade can go against us. And sometimes you do everything right, and still lose.

Every trading system works with probabilities. Losses are normal. Let your ego go and stop trying to force a win out of every single position you take. (Add this to your daily affirmation ritual if you must)

Stay focused on the long term

It’s easy to get caught up in the short-term movements of the market, but it’s important to remember that trading is a long-term game. By focusing on our long-term goals it becomes easier to stay disciplined. Every losing day can get you closer to your long-term goal, as long as you sit down, analyze what happened, and learn from it.

Take regular breaks

Trading can be mentally and emotionally exhausting, and it’s important to take regular breaks to recharge and refocus. By stepping away from the markets for a while, you can clear your mind and come back to our trading with a fresh perspective. This can help you avoid making rash decisions.

Learn from your mistakes

This is the big one. Realize that nobody is perfect, and everyone makes mistakes in their trading careers. It’s important to learn from these mistakes and use them as opportunities for growth and improvement. By analyzing your past mistakes and adjusting your strategies accordingly, you can become better trader and overcome your fears.

Good Backtesting software will make you a better trader

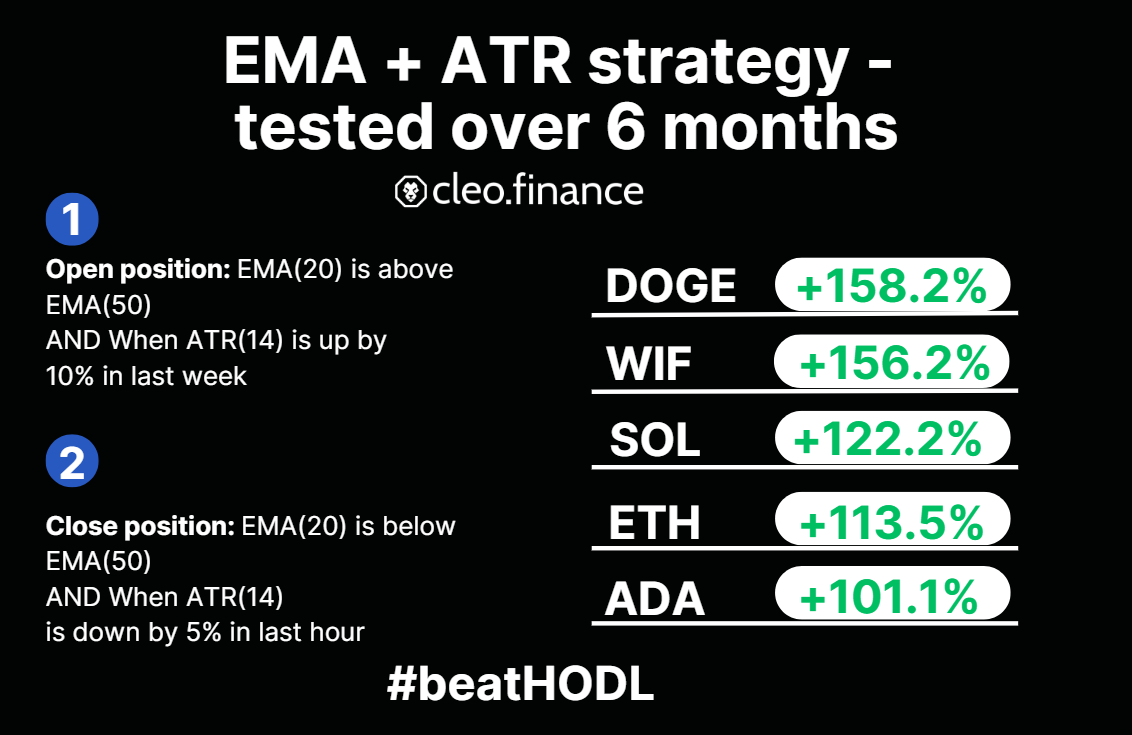

Unless you get incredibly lucky with your first strategy and just have success from the get-go you need a cheaper way to make mistakes and experiment with your strategy parameters. Most backtesting software tends to be clunky and inefficient. However, they are expansive or do not exist.

With the cleo.finance Manual Backtester this changes. Experience real conditions with market replay and easily gather backtesting statistics that will supercharge your strategy. Of course we also feature the Automated Backtester where you can check performance on historical data.

Backtesting is the best way to have probability on your side when trading, instead of fear.

Automate your trading process

Shameless plug – the trading platform cleo.finance does a fantastic job of keeping your emotions out of trading. You can set multiple take profits and stop losses, understand your risk-to-reward ratio, the trade’s impact on your portfolio and much more before you even place the trade. You can backtest your strategies, trade them live automatically, and much much more. Leveraging technology in your favor can yield a tremendous difference in your trading results.

Conclusion

The four main fears that traders face – fear of being wrong, fear of losing money, fear of leaving money on the table, and fear of missing out – can have a significant impact on our success in the markets. However, with the right approach and mindset, these fears can be overcome and transformed into positive drivers for our trading.

By accepting that being wrong is a natural part of the trading process, managing our risks, having a clear exit strategy, and resisting the temptation of FOMO, we can overcome these fears and become more confident and successful traders. By doing so, we can capitalize on opportunities, make informed decisions, and achieve our trading goals. So embrace these fears, overcome them, and take control of your trading journey.