Backtesting software statistics – how to improve your trading strategy: forex, crypto, stocks & more7 min read

Traders are so used to software that makes it very difficult for them get and interpret backtesting results, that many give up. Or what backtesting software you’re using for forex, can’t run backtesting for stocks or crypto.

cleo.finance’s Manual and Automated Backtesters change that. Everything is calculated for you and the data provided gives you actionable insights that you can implement immediately. Not to mention, the backtesting process itself is very intuitive and you can backtest using indicators, drawings on the chart, or whatever else you’d like.

What backtesting statistics are important?

This will depend on your trading strategy and what you are trying to optimize. There are many backtesters for forex, crypto or stocks that offer the top level metrics like Win Rate and Risk to Reward Ratio, but if they are inadequate how do you improve them?

This is where the cleo.finance difference lies. You won’t only get the Key Performance Indicators, but you’ll also get what makes them. Best trading times, how you close positions, does your Stop Loss get triggered often – while your Take Profit is reached less than you would like to? By working on those details, the high-level metrics will go up.

Our backtesting software does not only show you what’s wrong with your strategy, but how to fix it.

What statistics are available with backtesting:

After running your backtest on the software, you will have many comprehensive data points to look at. Some are classic and some are move novel approaches.

Some statistical highlights include:

Win rate split by longs and shorts

Return

Risk to Reward Ratio

Profit Factor

Sharpe Ratio

Sortino Ratio

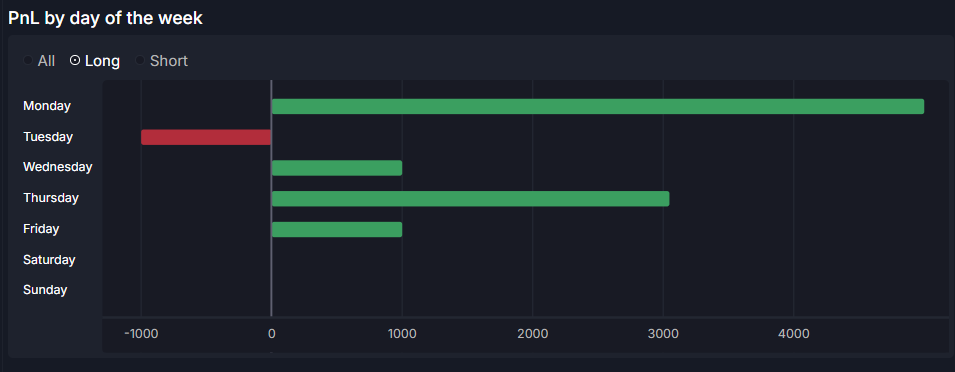

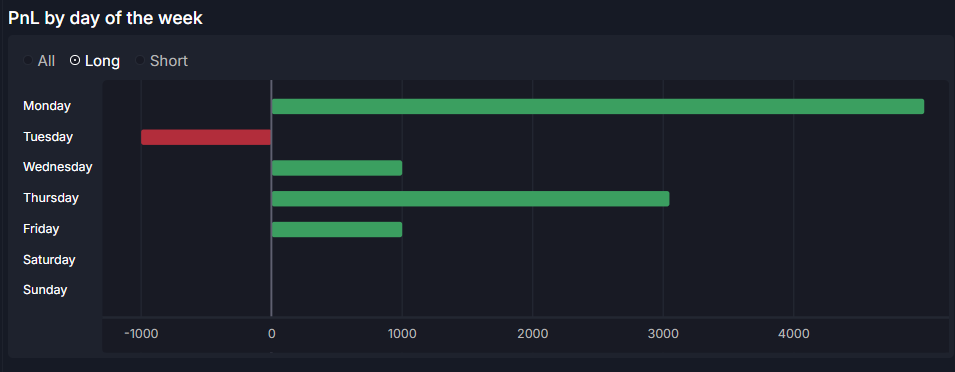

PnL by day of the week

Average/Max loss

Average/Max win

Average/Max drawdown

Average position duration

Longest/Shortest win position

Avg. # of Position per Day/Week/Month/Year

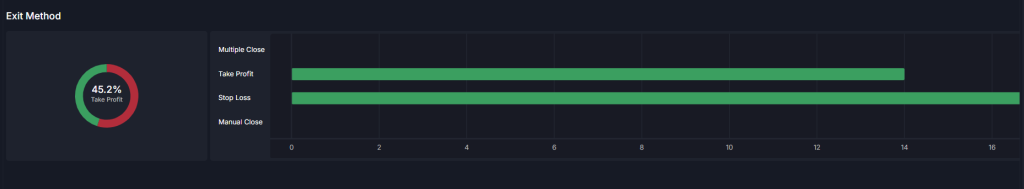

Use of Exit Method: Stop Loss, Take Profit, Manual Close

Risk of Ruin – How many positions would it take for you to lose a certain % of your account

& more

How to improve my trading with backtesting statistics & data

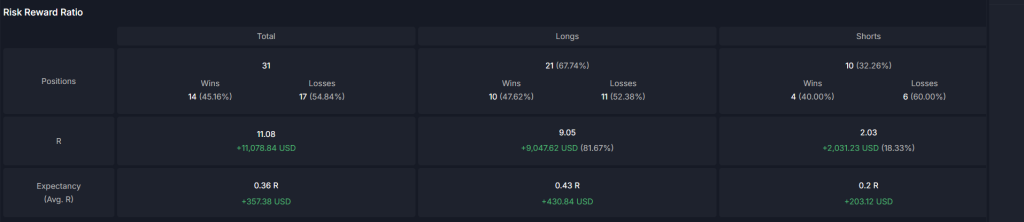

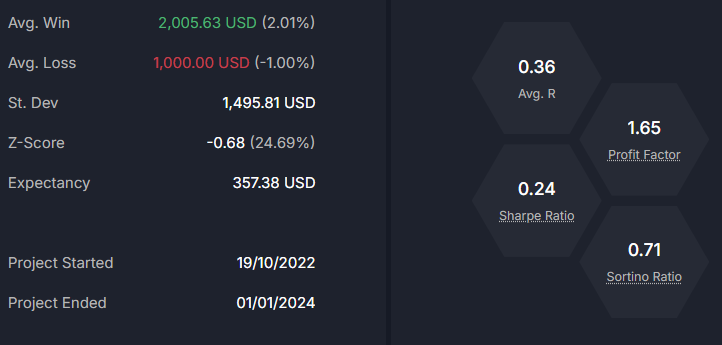

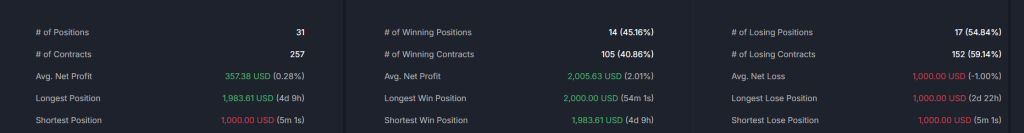

These are the general results discussing the Risk to Reward Ratio of a forex trading strategy we backtested on AUDUSD over 3 months. You can see we have a nice profit of 11.08% on 31 positions out of which we’ve gotten more longs than shorts.

It’s already clear that the win rate is not what makes this strategy – more losses are expected than wins – this is already a big plus to know when you’re live trading. Otherwise, you might want to give up when things are not going your way. The average profit is $2005 and an average loss $1000.

The Sortino Ratio is much higher than the Sharpe ratio which is good as while we will see volatility with this strategy, much of it comes from the upside.

The results are satisfactory, but let’s look under the hood to see if there’s something we can do easily to increase profit.

How to Improve your Trading Strategy with Backtesting Statistics

The easiest thing you can do is check if there are some days or times when your strategy underperforms. Various factors contribute to this and it’s one of the easiest fixes to your trading.

It’s immediately clear that the negative performance tends to happen on one day of the week – Tuesday. In addition, this day is very active for the strategy, potentially causing more damage.

Filtering this by longs/shorts uncovers a key detail: it’s longs on Tuesday that are perilous, shorts don’t really happen then.

Knowing this you can try a version of the backtest when you skip long positions on this day and see if the strategy performance improves. Or if you are eager to go live, be much more cautious on Tuesdays if you even trade at all.

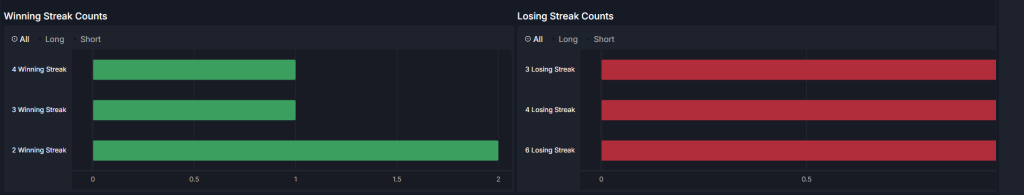

Secondly when looking at the winning streak, it goes up to 4. Could not taking the next position after having a great streak like that prevent a loss?

Mind you streaks so long happen rarely, another point to possibly pick apart.

Examining exit methods we see the Stop Loss tends to get hit more often than the Take Profit. That’s fine as we are discussing a strategy of 2R, but some traders may choose to thinker with these distances and see if incremental changes increase the win rate.

There are already a few things you can focus on if interested in trying to get better results when trading forex, crypto or stocks.

Backtesting Will Help You Execute your Strategy with Discipline

When live trading, there are so many perils that might derail your execution that knowing you have probability on your side is everything.

With these backtest results you know how long you are holding a winning position on average, as well as a losing one. You can hold off for hours even if things are not going your way.

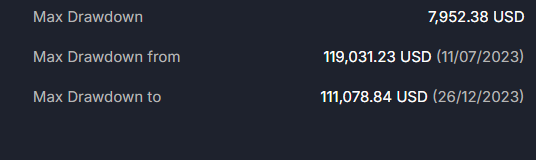

Drawdown is a tough thing to handle in forex, crypto, and stocks so knowing that it can go up to 7,952.38 USD can help you keep a cool head when the market turns against you with repetition.

You also know that when you lose 3 trades it is likely the next one will be a winner. Same thing with taking a loss (see image in the previous section) – having it happen twice in a row can be destabilizing to your discipline but knowing that the next one should yield a different result is an important fact to focus on.

Backtesting Statistics Conclusion

When people wonder if backtesting is worth it, they wonder if the time and effort they put in will pay off. If you must go through a painstaking process on an outdated platform to get jumbled numbers that will not help you improve your strategy or trade better live of course not.

But if you spend a fraction of the time on intuitive backtesting to get immediate actionable insights that you can implement, you’re doing your trading career a disservice by leaving money on the table.

With cleo.finance you know what to improve when evaluating overall performance and what the probabilities are when live trading. That’s an ideal position to be in as a trader.