Profitable DOGE (+112%) & WIF (+182%) Trading Strategy – Improvement With Backtesting4 min read

Backtesting is our bread and butter at cleo.finance so when Rich, our crypto trading strategy savant showed us what he stumbled upon for WIF and DOGE we were thrilled to share. What he did when working on this strategy is the perfect illustration of why a good backtesting software can supercharge your profits.

The First Version of the DOGE, WIF Trading Strategy

The initial version of this strategy already had great results. It was a simple approach, based on 2 indicators that was already somewhat refined.

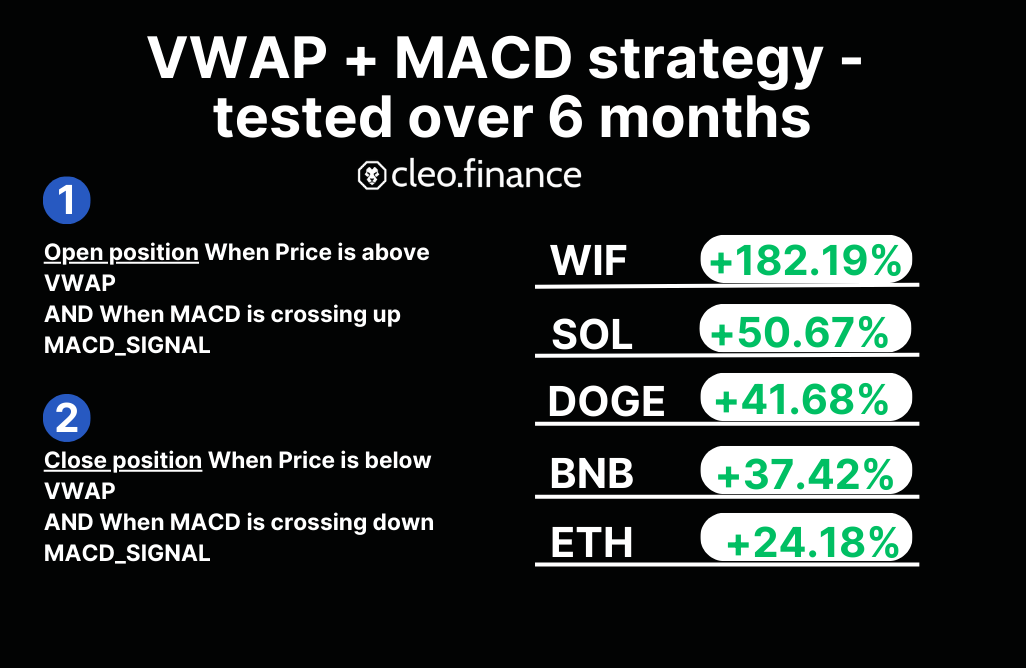

The MACD, VWAP 1H Trading Strategy Rules

On the 1 Hour Timeframe:

– Open position When Price is above VWAP AND When MACD is crossing up MACD_SIGNAL

– Close position When Price is below VWAP AND When MACD is crossing down MACD_SIGNAL

No Stop Loss or Take Profit.

Pretty simple right? We tested this strategy on 6 months of historical data from mid 2024 on multiple assets.

The MACD, VWAP 1H Trading Strategy Backtesting Results for DOGE, Bitcoin & more

What we found through backtesting on Bitcoin and multiple alts was more than promising:

BTC: +28.05% gain while holding in the same period would have resulted in a 6.23% gain

BNB: +75.75% gain while holding in the same period would have resulted in a −5.76% loss

DOGE: +112.31% gain while holding in the same period would have resulted in a −1.13% loss

ETH: +27.26% gain while holding in the same period would have resulted in a −23.08% loss

AVAX: +31.11% gain while holding in the same period would have resulted in a −39.21% loss

XRP: +51.95% gain while holding in the same period would have resulted in a −5.12% loss

WIF: +19.68% gain while holding in the same period would have resulted in a −43.36% loss

LINK: +27.35% gain while holding in the same period would have resulted in a −28.42% loss

We saw loses on SOL.

You can see that the results on DOGE are stellar, although most performances should not be dismissed as this was a very slow period in the crypto market. Automating this as a crypto bot is very easy as well.

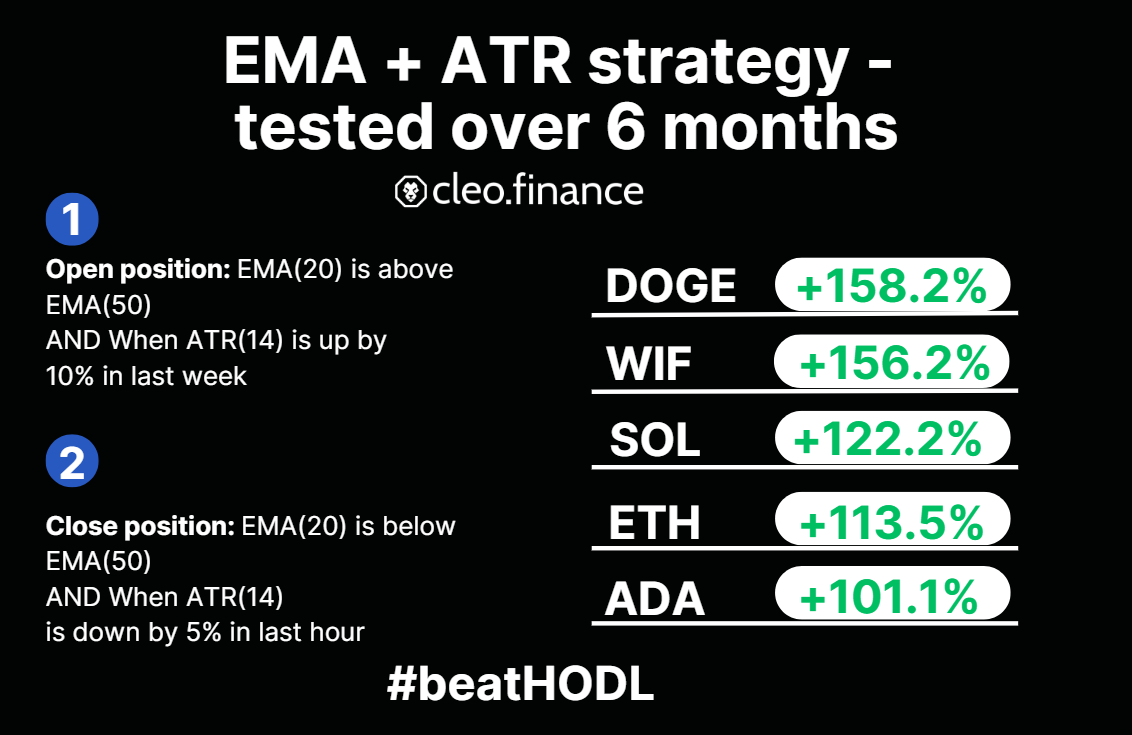

Improving The MACD, VWAP 1H Trading Strategy

When you have a backtested strategy that works across plenty of alts small changes can bring big improvements for a particular pair. Backtesting needs to be done correctly so you should be validating across timeframes. In this instance we do want to get more positions.

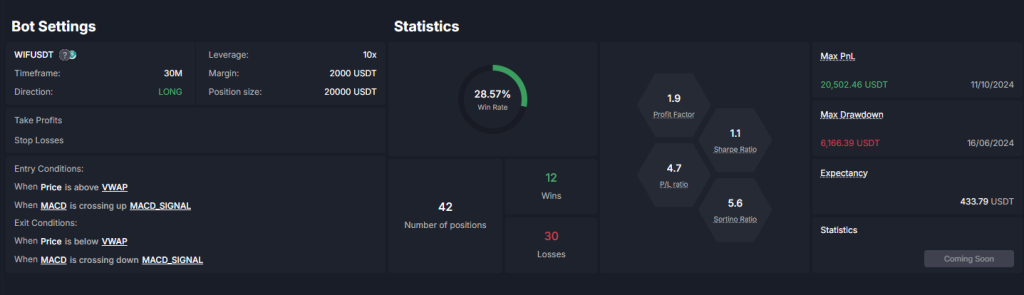

The hunt for an even bigger yield for WIF ended quickly as a small change made all the difference: changing the timeframe of the strategy to the 30 min.

Same strategy rules, open and close as above – no stop loss or take profit

The MACD, VWAP 30 min Trading Strategy Backtesting Results for WIF, Bitcoin & more

The results for WIF were absolutely stellar, but also some other alts showed a great performance just by making this small change to the 30 min timeframe:

WIF: 182.19% gain

SOL: 50.67% gain

DOGE: 41.68% gain

BNB: 37.42% gain

ETH: 24.18% gain

AVAX: 19.34% gain

BTC: 7.76% gain

LINK: 5.49% gain

The gains on WIF are unprecedented, but the strategy also looks promising for SOL and other alts. It’s a testament to backtesting being crucial to any trader’s decision making. The second backtest took 2 clicks and a few seconds and gave you the ability to increase profits by having probability on your side.

Backtesting statistics also show that the strategy has a skinny win-rate of a little less than 30%. When trading it you will be aware of this and expect to lose most trades, but when winning you win big with an average net profit of 38.5%. Information like this makes all the difference when executing.

There is plenty of more data features in every backtest on the platform including expected streaks, best/worst trading days/times, drawdown, splits by longs and shorts & more.

Of course you can fully automate this strategy too in minutes and run it on Binance or OKX through cleo.finance.

Try creating your version of the strategy or polish another idea on cleo.finance. If you want to backtest a strategy that is not based on indicators and need to simulate your trading by replaying the market check out our Manual Backtester.