Bitcoin trading strategies backtested results – Week 433 min read

After an “up only” week we got one where we can profit from both directions with our trading strategies. Once Bitcoin stalled close to $70,000 it was time to look for short term shorts. The sweep of the low on Wednesday gave a nice chance to grab some longs.

Here’s a full list of all the trading strategies you can use on Bitcoin, SOL, WIF or any other alt. They can be backtested or traded as crypto bots on Binance or OKX through cleo.finance. Of course if you want to create your own version feel free to- you can use them for forex, stock, indices or whatever else you trade.

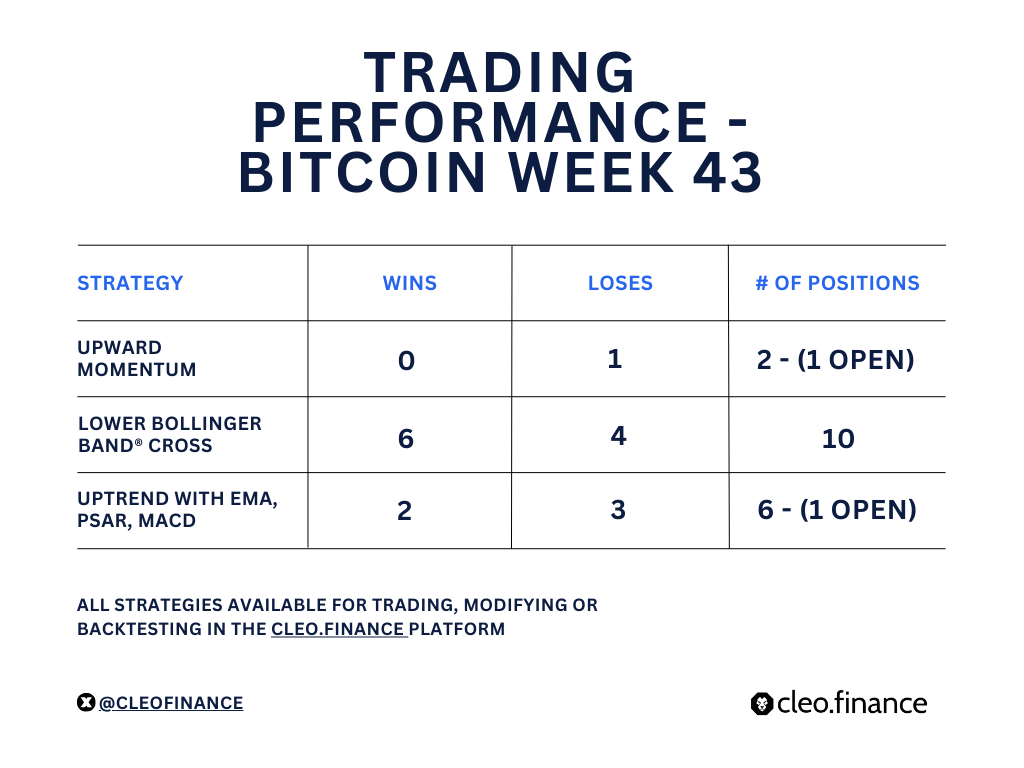

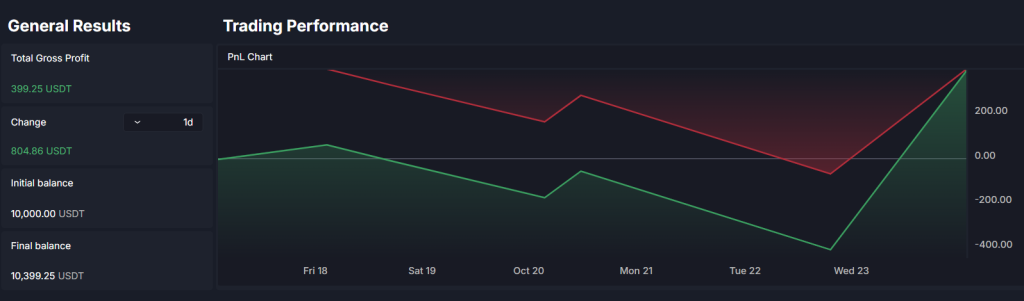

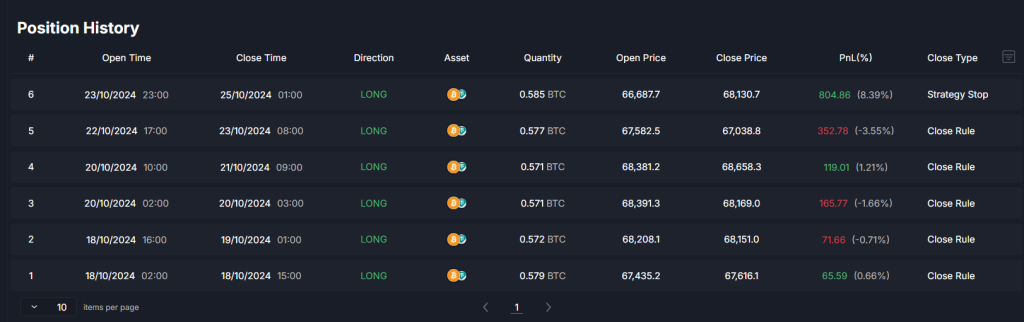

How did our trading strategy templates perform?

Upward Momentum had an excellent long at the start of the week. After the mid-week low it entered a position again. It remains open.

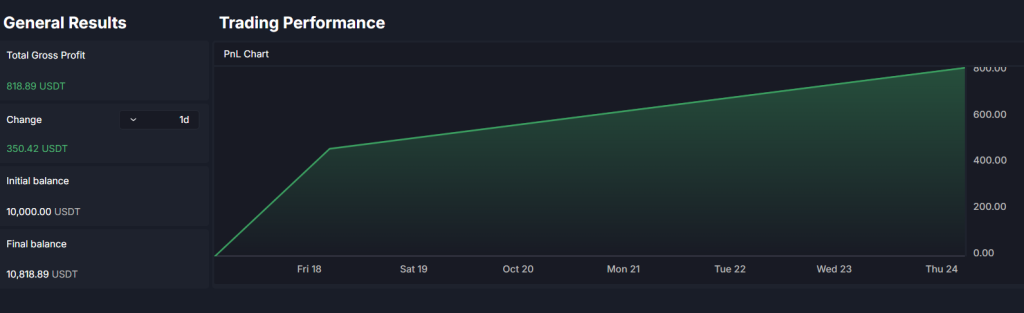

Lower Bollinger Band® cross kept loses under 1% most of the time and stayed in winning positions longer, amounting to a good trading week on the 15 min timeframe.

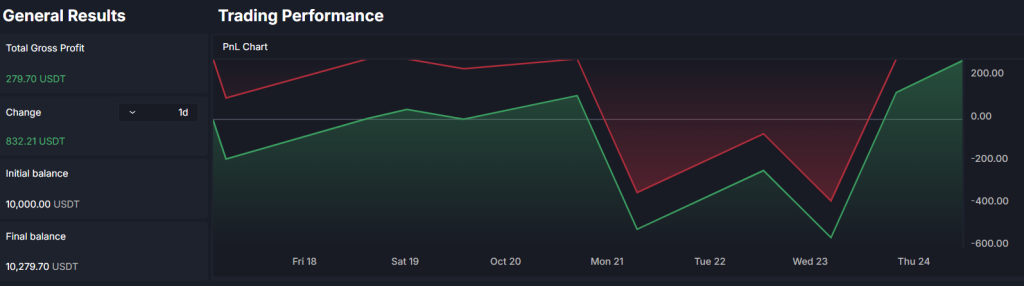

Uptrend with EMA, PSAR and MACD was overly active, but once it settled in a long on the 23rd it remained steady. This was the right call.

What’s next for Bitcoin?

At the moment there could be another sweep of the lows as confidently recapturing $68,000 does not seem to be in store for the bulls. However as we are still above all meaningful MAs with some stability, so the outlook remains positive.

Source: TradingView

The next two weeks are the final stretch to the US election, so we may see rapid volatility in response to news. Open positions must be protected.