Trading psychology: J-Curve – Why most traders fail 9 min read

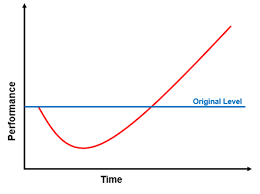

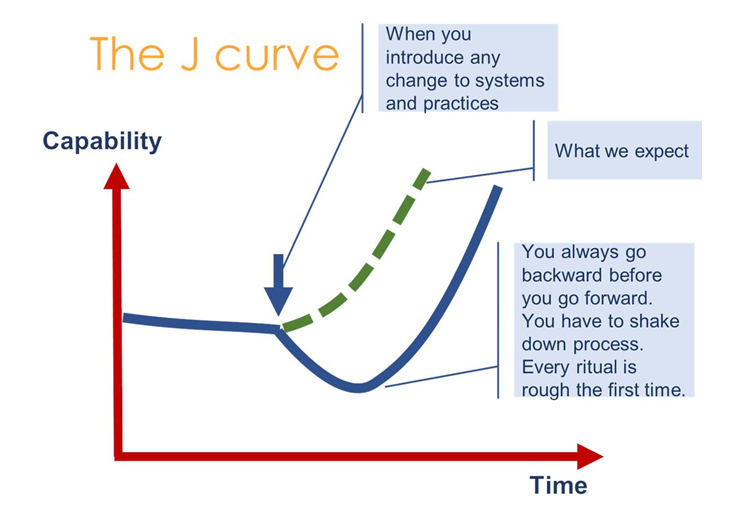

Often things must get worse before they get better. It’s what the J-Curve explains, and it’s truly one of those concepts that once you notice you can’t stop seeing everywhere.

It’s why sometimes you might feel hopeless as a trader. Like you’re worse off than when you started learning and trading even.

Every trader at the beginning of their journey invests time and money into learning and practicing. Yet the results may be disappointing or even negative.

Understanding the J-Curve and how it impact trading psychology

The concept comes from private equity firms and how their investments behave – they buy underperformers that usually dip some more before rising. It’s also used in political science, economics and medicine.

When you think about it most new endeavors can be described by the J-Curve. You start learning, sink in time and energy and for a while and it feels like it’s all for nothing. You feel hopeless, keep grinding anyway and if nothing else you become more efficient.

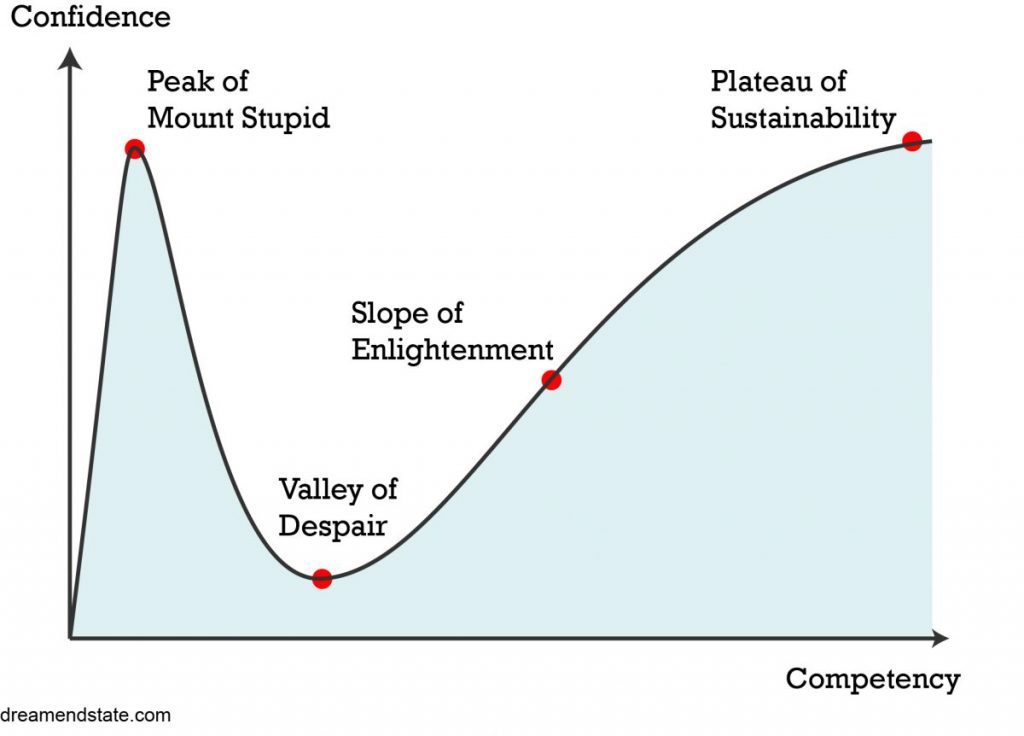

The way the J-Curve looks may remind you of a famous cognitive bias – The Dunning–Kruger Effect. This bias speaks about the disconnect between falsely perceived competence as the student does not even register how much more there is to learn.

The Valley of Despair and the bottom of the J-Curve feel similar.

As the only way is up, the basics start to take less and less time. Then the tougher things get crossed off faster. Slowly but surely, you are climbing out of the hole. Until you hit competence.

While the J-Curve may describe most learning processes, the bottom can hit traders quite hard. Feeling like you’re losing time is one thing, but losing money? That stings on a whole other level.

The learning phase of trading:

Brand new traders start learning the basics. Often a method offered by a guru that has made millions “by using this one simple strategy ™” revealed after joining a YouTube channel, Discord, Telegram and subscribing to a newsletter. A couple of wins aaand the market starts chopping them up. No biggie, the guru is ready to share one more “market secret™” but only in the paid group.

If they encounter backtesting it seems too difficult, or they can’t afford the platforms. Position by position their stack is shrinking while they feel inadequate. At a certain point they have to stop trading. They’ve spent all this time and money. Tried many approaches by many successful trading mentors who show “how to make millions while you sleep™”. And for what? Nothing. “Trading is a scam you can’t win”, “it’s all whale games anyway” and everyone knows “you can’t time the market.”

The discovery phase of trading:

Most give up at the bottom. At the point where they know what does not work, before they discover what does. Before they backtest their initial ideas, improve, make small incremental changes tweak how they manage risk. Learn to refuse to risk capital until they have an edge. After a bunch of iterations and removing a ton of fluff in their trading strategies something starts to click. A strategy that might be a winner.

The breakeven phase of trading:

What follows is the path to executional excellence. There will be mistakes which illuminate the importance of discipline. Struggles with trading psychology will make them want to quit again. Even fewer will escape themselves at this point.

After this entire struggle, the now intermediate trader starts to see the fruits. The prep is done, and the execution is boring as it should be. There are fewer surprises, the gains start to compound. Stress and excitement start to give way to confidence.

The growth phase of trading:

Our intermediate trader starts to notice patterns in the markets. Gets new ideas, tests them and builds an arsenal of what works. Recuperating losses chasing new PnL highs. Success is the final stop.

Tips and Strategies for Shortening the Negative Trading Period

You’ll encounter self-doubt, but you can compress the time you spend at the bottom of the J-Curve. More importantly you can prime your psychology to stick to a process instead of falling into dread and giving up.

This is what you need to do to become a successful trader that does not give up:

- Start working on a strategy

Grab some basics and start backtesting them. When something seems to be working start piloting the strategy.

- Paper trading

Sure, you may have good historical results, but do they match the direction of the markets right now? Paper trading is a risk-free way to find out.

Wise use of stop losses, take profits and managing position sizing as your portfolio evolves are the beating heart of your durability on the trading floor.

- Make a trading plan and stick to it.

“If this than that” is all there is to it. Making the plan is not difficult, but sticking to it will be. You will make mistakes but the sooner you start the sooner you can start reducing them.

- Learn about trading psychology and master it

Easier said than done, but learning about the main biases will decode your behavior. Understanding why you make mistakes is essential to fixing them or to put it eloquently: “Naming your enemy helps you defeat it.” If you can point to and name the root cause of the fear/error, you can formalize a plan to beat it

Trading biases: Common perpetrators include but are not limited to:

Overtrading – when traders start being aggressive and start opening and closing positions rapidly, with an increased size, or dump their plan for low time frame scalps.

Revenge trading – a response to a loss, an attempt to make it all back which always involves deviating from the plan,

Chasing losses – this behavior is basically gambling or forcing trades on losers to make it all back.

You can see that all of these psychological pitfalls involve deviating from the plan. Imagine going against an opponent in a sports game with the plan to “score the most points.” This is exactly what exuberant focus on the PnL is. Your plays will be disjointed. Your fitness will fail you if you go with an all-gas-no-breaks approach. Not to mention you will likely get crushed on defense as you never thought about it.

On the flipside entering the game with discipline and a focus on longevity: drawn out plays, practiced footwork, drilled rotations allows you to set the pace and win not only one game, but the championship.

So it is absolutely crucial that you make a plan and stick to it. When things don’t go your way, it’s better to shut down your computer and go touch grass than trying to make it all back with one trade.

Using the cleo.finance Position Player & Backtester to Validate Your Trading Strategies

A big reason for failing to backtest strategies, practice, or make changes to your trading approach is often the cost and difficulty of trading platforms. There aren’t that many options and those that do exist make the process so painstaking that you might as well go position by position in the charts.

Inadequate tools will drain your time instead of helping and some can be too expensive to justify the cost.

Cleo.finance was created to help traders overcome this by allowing them to quickly test, modify and automate their trading strategies. From multiple take profits and stop losses for every position that you can draw or type, to setting default risk for every trade to make sure you have exactly 1% or whatever you want on the line without calculating size for each position separately.

Of course all data is already in the platform so traders can hit the ground running. As we find helping traders who don’t have hefty trading fund yet important, the pricing is affordable and flexible.

If you can quickly examine and review your positions as they happen, monitor the conditions you’ve set and toy with the distances to TPs or SLs you’re more likely to do it. Same thing with testing results, it makes no sense to do tests where the results are a bunch of numbers as opposed to comprehensive statistics you can implement.

Conclusion

We explored the concept of the J-Curve in retail trading, impact on trading psychology, its application to the different stages of the trading journey, and some helpful tips and tools for achieving profitability faster. While the J-Curve can be daunting and frustrating, it’s also a sign of progress and potential.

By following the best practices we’ve discussed, and by leveraging the power of tools like the cleo.finance Backtester and Position Replay you can make the most of your trading experience and reach your financial goals with more confidence and efficiency. Remember, the J-Curve is not a destination, but a dynamic and ongoing process. Embrace it, learn from it, and enjoy the ride!