The Hidden Costs of Trading Slippage: Why Picking the Right Broker Matters6 min read

Trading is a game of probabilities, and every trader knows that slippage is a risk they have to take into account. However, many traders don’t realize that not all slippage is created equal. Some brokers may intentionally manipulate slippage to their advantage, artificially inflating the difference between the quoted and executed price of a trade. This can lead to significant losses for the trader, while the broker profits from the difference.

In this article, we’ll delve into the world of trading slippage, explore the differences between a-book and b-book brokers, and discuss how to pick the right broker to ensure you’re not falling prey to hidden costs. Before you read on, make sure you grab your free trading strategy on cleo.finance.

Table of Contents

What is slippage?

Slippage is the difference between the expected price of a trade and the actual price at which it is executed. It can occur when market conditions change rapidly, such as during periods of high volatility or low liquidity. While slippage is a natural part of trading, it can also be exacerbated by potentially malicious behavior by some brokers or exchanges, especially those that are unregulated.

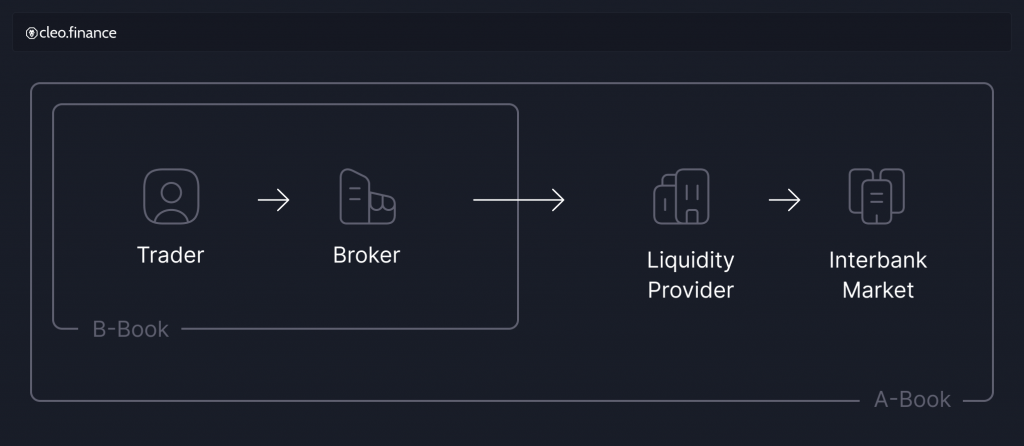

Brokers generally operate on one of two principles: A-book or B-book. A-book brokers pass their clients’ trades directly to the market, acting only as intermediaries and earning commissions on each trade. B-book brokers, on the other hand, take the other side of their clients’ trades, effectively betting against them. This means that B-book brokers have a direct interest in their clients losing money, which can lead to potential conflicts of interest.

Sometimes you can see a different naming: ECN, STP are A-book brokers, while Market Maker or Dealing Desk is a name for a B-book broker.

ECN brokers

ECN stands for “Electronic Communication Network.” ECN brokers use a network of liquidity providers, such as banks, dark pools, and other financial institutions, to provide their clients with access to the interbank market. These brokers pass their clients’ orders directly to the liquidity providers and earn a commission on each trade. ECN brokers typically offer very low spreads and fast order execution, making them popular among traders who value speed and transparency.

STP brokers

STP stands for “Straight Through Processing.” STP brokers are similar to ECN brokers in that they also use a network of liquidity providers to provide their clients with access to the interbank market. However, instead of passing their clients’ orders directly to the liquidity providers, STP brokers typically aggregate their clients’ orders and then execute them as a single trade with one of their liquidity providers. STP brokers also earn a commission on each trade and typically offer low spreads and fast execution.

Market maker / dealing desk brokers

Market makers are brokers that provide liquidity to their clients by taking the other side of their trades. In other words, when a client buys a currency pair, the market maker sells that currency pair, and vice versa. Market makers earn money by charging a spread, which is the difference between the bid and ask price of a currency pair.

What’s the difference?

Both ECN and STP brokers are considered A-book brokers because they pass their clients’ trades directly to the market, acting only as intermediaries and earning commissions on each trade. This means that A-book brokers have no direct interest in their clients losing money and are generally considered to be more transparent and trustworthy than B-book brokers.

Market makers, on the other hand, operate as the counterparty to their clients’ trades and therefore have a direct interest in their clients losing money. This creates a potential conflict of interest between market makers and their clients, particularly when it comes to the pricing of trades. Market makers have control over the pricing of trades and can potentially manipulate prices to their advantage, “slow down” the execution or engage in similar behavior, which is harmful to the clients.

While not all B-book brokers engage in malicious behavior, the risk is significantly higher with these types of brokers, especially those that are unregulated.

How to prevent picking the wrong broker?

Unfortunately, excessive slippage and other potentially malicious behavior by brokers or exchanges is not something that can be easily detected with demo accounts. And when looking for reviews online, put a tinfoil hat on: take the vague reviews with a grain of salt, while specific reviews as the actual experience of the users. I guarantee that most of the vague reviews will be positive, while the specific ones will be leaning more toward the negative side. It is imperative to do your own due diligence when selecting a broker.

Also, don’t be afraid to ask questions to the broker directly. A reputable broker will be transparent about the type of broker they are and the scaling options they offer. In many jurisdictions, brokers are required to disclose this information upon request, so don’t hesitate to ask whether they are an a-book or b-book broker, ask them to send you a link to a regulator’s website where you can verify that information, what plans for higher volume traders they have, ask about the execution speed, and any other questions you might have.

Conclusion

Slippage is a reality of trading, but it’s important to understand that not all slippage is created equal. By choosing the right broker and trading with transparency and regulation in mind, traders can help minimize its impact on their bottom line. A-book brokers, such as ECN and STP brokers, typically offer more favorable trading conditions and execution quality, while B-book brokers, such as market makers and dealing desk brokers, may have conflicts of interest and artificially inflate slippage.

To avoid falling victim to artificially inflated slippage, traders should opt for regulated A-book brokers and take the time to figure out what type of broker they’re dealing with by asking questions. A reputable broker should be transparent about their type, scaling options, execution speed, and other relevant information.

Picking the right broker is crucial for minimizing slippage and maximizing trading performance. By doing your due diligence and choosing wisely, you can put the odds in your favor and achieve your trading goals. But before you even start thinking about trading live, you should have a reliable trading strategy in your hands. Read about how to create a strategy, and our beginner’s guide to backtesting.